Daily Volume-Weighted Average Price Reference:

Calculation Time:

Executed daily at 00:05:00 UTC, using trade data from the previous UTC day (00:00:00 to 23:59:59).

Data Sources:

Trades are aggregated from: Biconomy, BingX, BitMart, Coinex, and MEXC.

Calculation Logic:

- Hourly Partitioning: The day is split into 24 one-hour intervals.

- Volume-Based Quartile Filtering: Within each hour, trades are sorted by price and total volume is calculated. The lowest 25% and highest 25% of cumulative volume are excluded to remove outliers. If a trade crosses a quartile boundary, its volume is split to maintain exactly 50% total volume.

- Hourly VWAP Calculation: For the middle 50% volume:

- Each trade’s price is multiplied by its volume.

- The results are summed and divided by the filtered volume to get the volume-weighted average price.

- Daily Price Derivation: The arithmetic mean of all valid hourly VWAPs is taken. If less than 18 of 24 hours have greater-than-zero volume, the daily price is not calculated to ensure consistency and security.

Design Benefits:

- TWAP-style time weighting

- Volume sensitivity

- Outlier resistance via quartile trimming

Click on the API Endpoints or Example API Requests buttons below for information on how to access this data.

Hourly Volume-Weighted Average Price Reference:

Calculation Time:

Price calculated hourly at {hour}:05:00 UTC, using trade data from the previous hour.

Data Sources:

Trades are aggregated from: Biconomy, BingX, BitMart, Coinex, and MEXC.

Calculation Logic:

- Quarterly Partitioning: Each hour is split into four 15-minute intervals.

- Volume-Based Quartile Filtering: Within each 15-minute interval, trades are sorted by price and total volume is calculated. The lowest 25% and highest 25% of cumulative volume are excluded to remove outliers. If a trade crosses a quartile boundary, its volume is split to preserve exactly 50% of total volume.

- Quarterly VWAP Calculation: For the filtered 50% of volume:

- Each trade’s price is multiplied by its volume.

- The result is summed and divided by the mid-volume total to compute the volume-weighted price for the interval.

- Hourly Price Derivation: The arithmetic mean of all valid 15-minute VWAPs is taken. If less than 3 of the 4 quarters contain trading volume, the hourly price is not calculated.

Design Benefits:

- TWAP-style time weighting

- Volume sensitivity

- Outlier resistance via quartile trimming

Click on the API Endpoints or Example API Requests buttons below for information on how to access this data.

CURRENT DAILY AVERAGE:

wallywallet.org/_api/v0/now/dailyavg/usdt/nexaHISTORIC LOOKUP DAILY AVERAGE:

wallywallet.org/_api/v0/dailyavg/usdt/nexa?time=< epoch seconds >CURRENT HOURLY AVERAGE:

wallywallet.org/_api/v0/now/hourlyavg/usdt/nexaHISTORIC LOOKUP HOURLY AVERAGE:

wallywallet.org/_api/v0/hourlyavg/usdt/nexa?time=< epoch seconds >LAST 24 HOURLY AVG PRICES:

wallywallet.org/_api/v0/now/oracle24LAST 30 DAILY AVG PRICES:

wallywallet.org/_api/v0/now/oracle30Current Averages require no query parameters, and reflect price for the previous period - day or hour - as of the time the request is made. If a price was not calculated for that period, the previous period's price is returned. Prices are calculated 5 minutes after the day or hour. All times are given in UTC. Prices are in units per Nexa Satoshi.

Historic Averages require one query parameter: time (in epoch seconds). The time parameter must be less than or equal to current time, to be considered valid. These endpoints return a price for the previous period - day or hour (if one was calculated) - prior to the value of epoch seconds given. Prices are calculated 5 minutes after the day or hour. All times are given in UTC. Prices are in units per Nexa Satoshi.

All APIs return a JSON object of:

{

"type": String,

"msg": {

"data": String (32 byte hex),

"signature": String (64 byte hex)

},

"epochSeconds": Long,

"price": String,

"pairPriceUnit": String

}

Example response:

{

"type": "Hourly Average",

"msg": {

"data": "4e455841000000005553445400000004f16ab6600000000b0b59ff905000000",

"signature": "2ae6eaddb3cd31842ceeb42079c7a25a86ec79f6e9c24c1b303007ee1dbeef24d313f90ba16a47b5e26106a904f4cfe86cea007c8373336382f490004999ab893"

},

"epochSeconds": 1722488399,

"price": "0.000002566283000",

"pairPriceUnit": "USDT/NEXA"

}

EXAMPLE API REQUEST:

Current Daily Average:

http://wallywallet.org/_api/v0/now/dailyavg/usdt/nexaCurrent Hourly Average:

http://wallywallet.org/_api/v0/now/hourlyavg/usdt/nexaHistoric Lookup Daily Average:

http://wallywallet.org/_api/v0/dailyavg/usdt/nexa?time=1722489634Historic Lookup Hourly Average:

http://wallywallet.org/_api/v0/hourlyavg/usdt/nexa?time=1722489634Last 24 Hourly Avg Prices:

http://wallywallet.org/_api/v0/now/oracle24Last 30 Daily Avg Prices:

http://wallywallet.org/_api/v0/now/oracle30Example msg.data parsing with kotlin code.

Returns parsed data object with four fields:

tickerA, tickerB, epochSeconds, and price

@Serializable

data class OracleObject(

val type: String,

val msg: OracleMsg,

val epochSeconds: Long,

@Serializable(with = BigDecimalSerializer::class)val price: BigDecimal)

val pairPriceUnit: String

)

data class ParsedOracleData(

val tickerA: String,

val tickerB: String,

val epochSeconds: Long,

val price: Long

)

fun parseOracleData(data: ByteArray): ParsedOracleData {

require(data.size == 24) { "Data must be exactly 24 bytes" }

val tickerA = String(data.sliceArray(0..3)).trimEnd { it.toInt() == 0 }

val tickerB = String(data.sliceArray(4..7)).trimEnd { it.toInt() == 0 }

val longBuffer1 = ByteBuffer.wrap(data.sliceArray(8..15))

.order(ByteOrder.LITTLE_ENDIAN)

val epochSeconds = longBuffer1.long

val longBuffer2 = ByteBuffer.wrap(data.sliceArray(16..23))

.order(ByteOrder.LITTLE_ENDIAN)

val price = longBuffer2.long

return ParsedOracleData(tickerA, tickerB, epochSeconds, price)

}

val response = client.get("https://wallywallet.org/_api/v0/hourlyavg/usdt/nexa?

time=1724382065").bodyAsText()

val message = Json.decodeFromString<OracleObject>(response).msg

val data = message.data

val signature = message.signature

val byteArray = data.fromHex()

val parsedOracleData = parseOracleData(byteArray)

Example msg.signature validation with kotlin code.

class PriceDataPoint(name: String? = null, _nsl: NSL? = null): PackedStructure(name, _nsl)

{

constructor(_tickerA: String, _tickerB:String, _epochSeconds: Long, _priceAinB: Long):this()

{

tickerA.curVal = _tickerA.toPaddedByteArray(4)

tickerB.curVal = _tickerB.toPaddedByteArray(4)

epochSeconds.curVal = _epochSeconds

priceAinB.curVal = _priceAinB

}

val tickerA: Nexa.npl.NBytes by Nexa.npl.PBytes(4)

val tickerB: Nexa.npl.NBytes by Nexa.npl.PBytes(4)

val epochSeconds: Nexa.npl.NInt by Nexa.npl.PInt(8)

val priceAinB: Nexa.npl.NInt by Nexa.npl.PInt(8)

}

val checkData = PriceDataPoint(

parsedOracleData.tickerA,

parsedOracleData.tickerB,

parsedOracleData.epochSeconds,

parsedOracleData.price

).toByteArray()

val hashedData = libnexa.sha256(checkData)

// use wallywallet.org pubkey

val pubKey = "well-known pubKey goes here"

val pubKeyBytes = pubKey.fromHex()

val verify = libnexa.verifySignedHashSchnorr(hashedData, pubKeyBytes, signature.fromHex())

assertTrue(verify)

WELL-KNOWN ORACLE PUBKEY:

03b4a3ebc12e7c6a35c3e7dc2385713059c3429f6efdc302f410346712a66fffef

PARSING OF PRICE ORACLE API's MSG.DATA:

Data is stored in a 24-byte packed structure, which consists of the following:

- 4-byte zero-padded byte array containing a string representing tickerA

- 4-byte zero-padded byte array containing a string representing tickerB

- 8-byte (little endian) integer representing epoch seconds at the end of the calculated interval

- 8-byte (little endian) integer representing the calculated price x 1e16

Since decimal values are prone to rounding errors, the 1e16 multiplier is used to transfer a more stable Long value. An 8-byte Kotlin Long can support values up to about 9.22 x 1e18, therefore providing support of prices up to about 922 units of a given currency, per Nexa Satoshi.

msg.data is this 24-byte packed structure, converted to a hex string.

Once msg.data has been parsed (see example at right), the tickerA and tickerB values should reflect the asset types from the endpoint queried (in all capitals, "NEXA" always tickerA). The parsed epochSeconds value should match the epochSeconds field returned in the response from the http request. The parsed price value divided by 1e16 should match the price field returned in the response from the http request. Price units are specified per Nexa Satoshi.

VALIDATION OF PRICE ORACLE API's MSG.SIGNATURE:

The parsed oracle data must first be loaded into the PriceDataPoint data structure.That data is then hashed. The published wallywallet.org wallet's public key (in bytes form), the hashed data, and the signature provided from the API (in bytes form) are all passed to verifySignedHashSchnorr() available in the libnexakotlin library. This function should return TRUE for any valid signature.

EXAMPLE REQUESTS:

Click to copy URL

Current Price:

https://wallywallet.org/_api/v0/now/nex/usdt24h Change:

https://wallywallet.org/_api/v0/now/change24hMinute-by-Minute (24h):

https://wallywallet.org/_api/v0/day/usdt/nexaKline (MEXC, 15-min):

https://wallywallet.org/_api/v0/daykline/usdt/nexa?site=mexc.com&start=1759320000&interval=900PDQ (Bitget, 1-day):

https://wallywallet.org/_api/v0/pdq/usdt/nexa?site=bitget.com&start=1759320000&count=288&interval=12015-min Volume (24h):

https://wallywallet.org/_api/v0/volume-15m/usdt/nexa?start=1759320000&count=96Daily Volume (30d):

https://wallywallet.org/_api/v0/volume-daily/usdt/nexa?start=1759320000&count=30Order Book Depth:

https://wallywallet.org/_api/v0/now/depth/usdt/nexa?site=mexc.comDATA ENDPOINTS

Current Price

/_api/v0/now/nex/usdt

Volume-weighted average Bid, Ask, Last price across all exchanges. 24H Volume in NEXA

Response: { Bid, Ask, Last, Volume } - All BigDecimal strings

24h Price Change

/_api/v0/now/change24h

Price 24h ago, current price, percent change, 24h high/low.

Response: { price24hAgo, currentPrice, changePct, high24h, low24h }

Minute-by-Minute Prices

/_api/v0/day/usdt/nexa

Mid-prices ((bid+ask)/2) for last 24 hours, one per minute.

Response: { price: ["0.000000580", ...] } - Array of price strings, most recent last

Kline (15-min Candlesticks)

/_api/v0/daykline/usdt/nexa?site=&start=&interval=900

Exchange-specific 15-minute OHLCV candlestick data. Interval is fixed at 900 seconds.

Response: Array of { openTime, open, high, low, close, volume }

Price Data Query (PDQ)

/_api/v0/pdq/usdt/nexa?site=&start=&count=&interval=

Exchange-specific price snapshots at configurable intervals.

Response: Array of { epochSeconds, min, max, last, bidmin, bidmax, bidlast, askmin, askmax, asklast, nsamples }

15-Minute Volume (USDT)

/_api/v0/volume-15m/usdt/nexa?start=&count=96

15-minute volume buckets. Use count=96 for 24 hours of data. Add /{exchange} for per-exchange data.

Response: Array of { epochSeconds, volume }

Daily Volume (USDT)

/_api/v0/volume-daily/usdt/nexa?start=&count=30

Daily volume totals across all exchanges. Use count=30 for one month of data.

Response: Array of { epochSeconds, volume }

Order Book Depth

/_api/v0/now/depth/usdt/nexa?site=

Current bid/ask order book for specified exchange.

Response: { timestamp, bids: [{p, v}...], asks: [{p, v}...] }

Where p = price, v = volume (NEXA)

Supported exchanges (site param): mexc.com, bingx.com, coinex.com, bitmart.com, bitget.com, biconomy.com

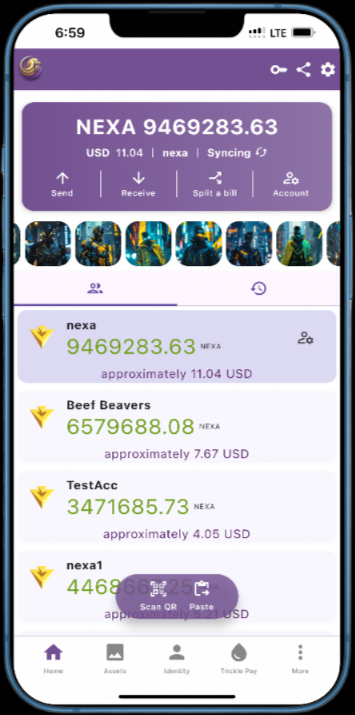

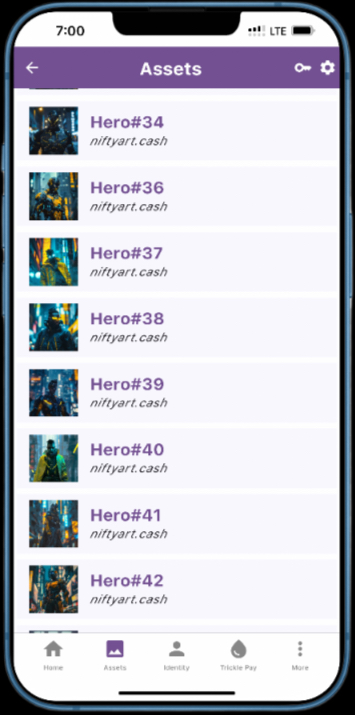

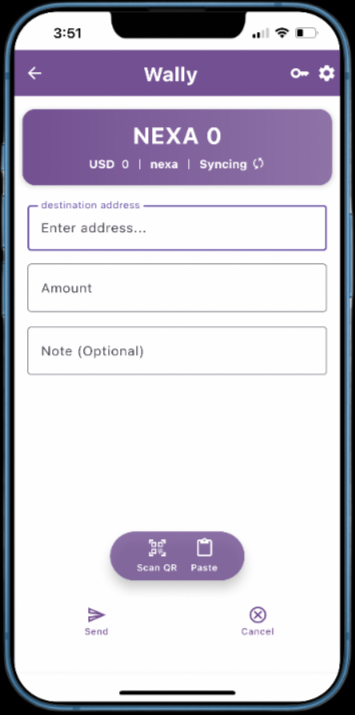

The power of the Nexa

network and ecosystem, at

your fingertips.

Wally Wallet is a self custodial digital wallet empowering users to easily send, receive, and manage digital assets like $NEXA, tokens, and NFTs. With integrated NFT viewing, comprehensive transaction history, and specialised features like split a bill or multi-account support, Wally makes managing your digital world secure, and effortless.